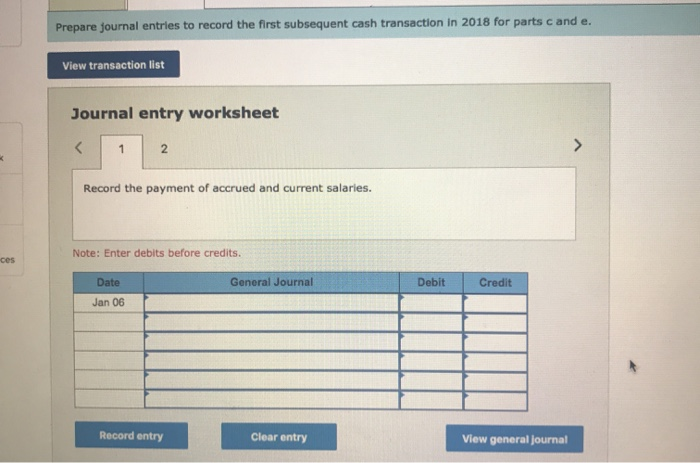

Accounting Journal Entry Worksheet Monday December 31 2017

Record entry Clear entry View general Journal Prey. Transaction General Journal Debit Credit a.

Arnez Company S Annual Accounting Period Ends On Chegg Com

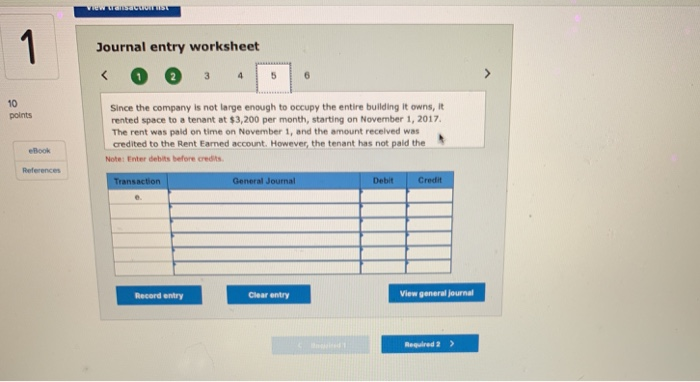

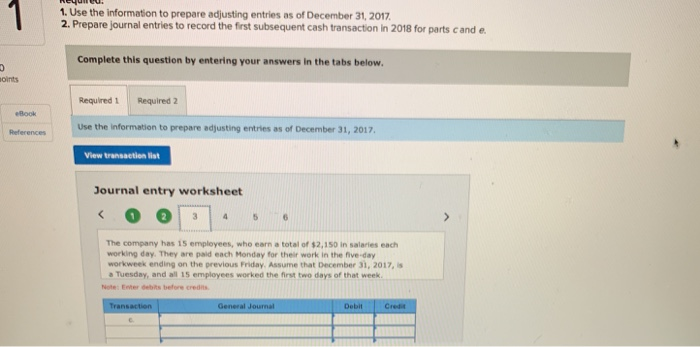

This requires an entry to debit Salaries Expense and to credit Salaries Payable.

Accounting journal entry worksheet monday december 31 2017. Required Using the Excel file provided. The following information concerns the adjusting entries to be recorded as of that date. 35 rows Analyzing transactions and recording them as journal entries is the first step in.

57500 cash and Rs. Discover learning games guided lessons and other interactive activities for children. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

4 The company estimates that utilities used during December for which bills will be received in January amount to 40000. On December 31 2017 Dyer Inc. This will result in a compound journal entry.

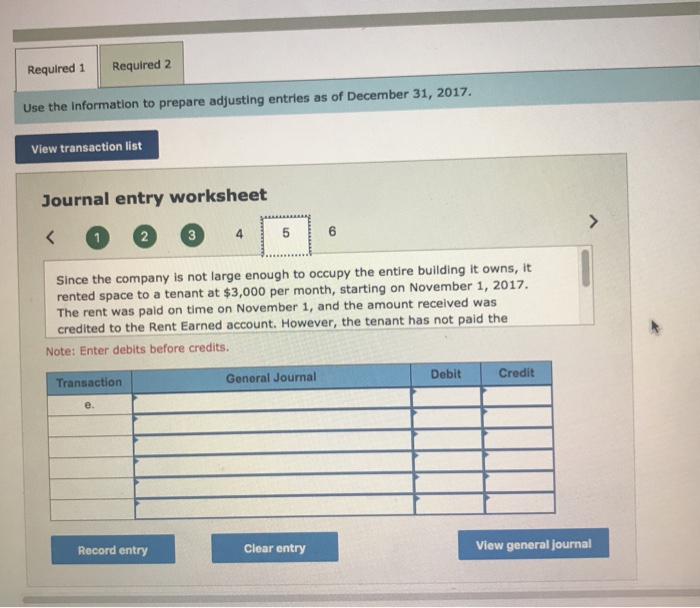

The entries for the 10 years are as. Inventory at 31st October 2017 is 520. Prepare any necessary adjusting journal entries on December 31 2017 in relation to transactions and events a through e.

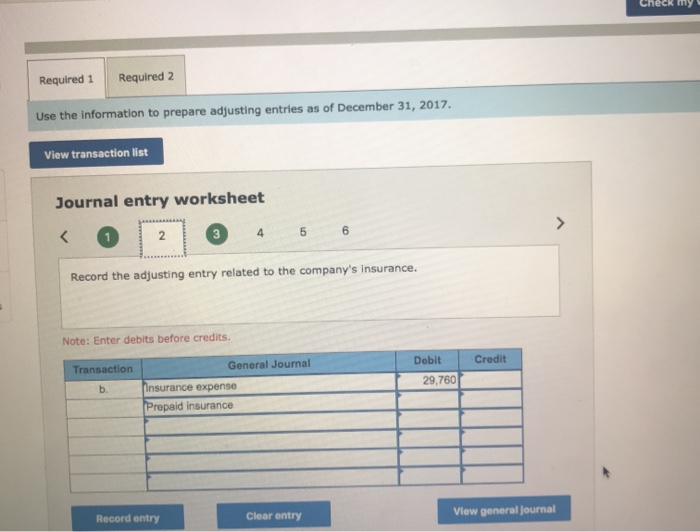

Worksheet 3 GENERAL JOURNAL Date Accounts Debit Credit Dec. 1 of 4 Next View transaction list Journal entry worksheet 1 4 5 6 Record the adjusting entry related to the companys insurance. 3000 cash for an insurance policy covering the next 24 months.

The bill would be received in January 2017. Hashim Khan the owner invested Rs. As of December 31 there are 10640 unpaid labor hours already worked at an average hourly rate of 34.

Youll notice the above diagram shows the first step as Source Documents. Discover learning games guided lessons and other interactive activities for children. On December 29 2017 the company completed a 7000 service that has not been billed or recorded as of December 31 2017.

Statement of Financial Position for 31 October 2017. Journal entries are important because they allow us to sort our transactions into manageable data. The bonds are dated December 31 call for semiannual interest payments on June 30 and December 31 and mature in 10 years on December 31.

Because this is the end of the annual accounting period the company bookkeeper prepared the following preliminary income statement 120000 Income Statement 2017 Rental Revenue Expenses Salaries and Wages Expense 29500 Maintenance Expense 13000 Rent Expense 10800 Utilities Expense 4800 Gas and Oil. The following journal entry would be recorded for utilities payable. Prepare general journal entries for the following transactions of a business called Pose for Pics in 2016.

Because the payday for the week beginning Monday December 31 2017 is not paid until Friday January 4 2018 it is necessary to make an adjusting entry to accrue salaries through December 31 2017. Completed its first year of operations. You are required to pass adjusting closing entries and worksheet.

The rate per unit is 10. Record the adjusting entry on Dec 31 for insurance expired. 600012 500 per month May to Dec 8 months x 500 4000 expired Insurance expense 4000 Prepaid insurance 4000 2017 Mr.

At December 31 st 2016 the balances in the ledger accounts prior to making adjusting entries. Consider the following diagram. COMSATS Consulting Services CCS was establishing in 1999.

W3 assignment templatexlsx 1. Statement of comprehensive income for 31 October 2017. On 2010 December 31 Valley issued 10-year 12 per cent bonds with a 100000 face value for 100000.

In this case the amount of accrued salaries at December 31. Prepare Journal accounts and Ledger accounts balance off the accounts. Valley made the required interest and principal payments when due.

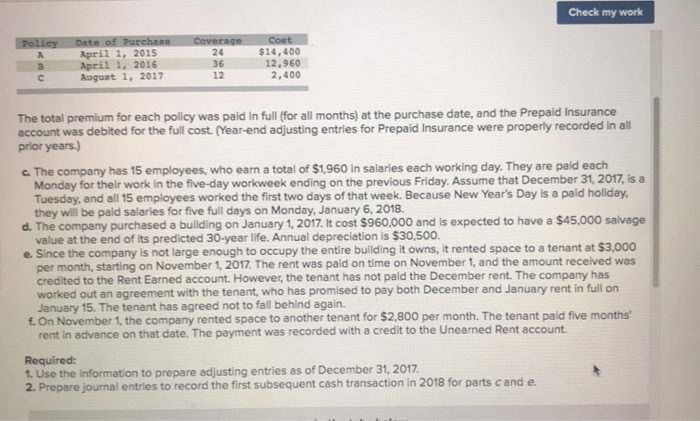

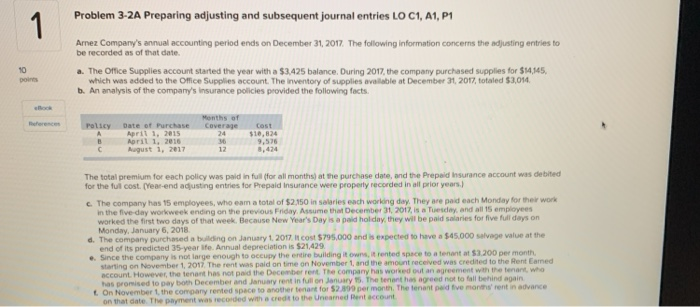

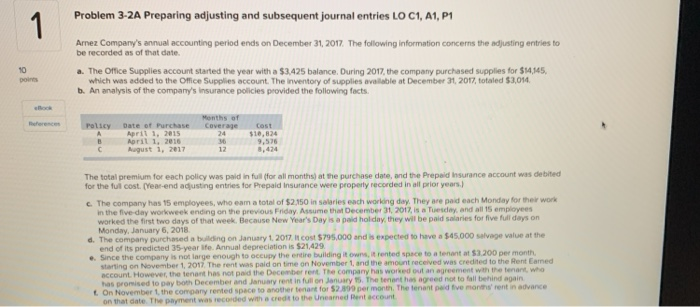

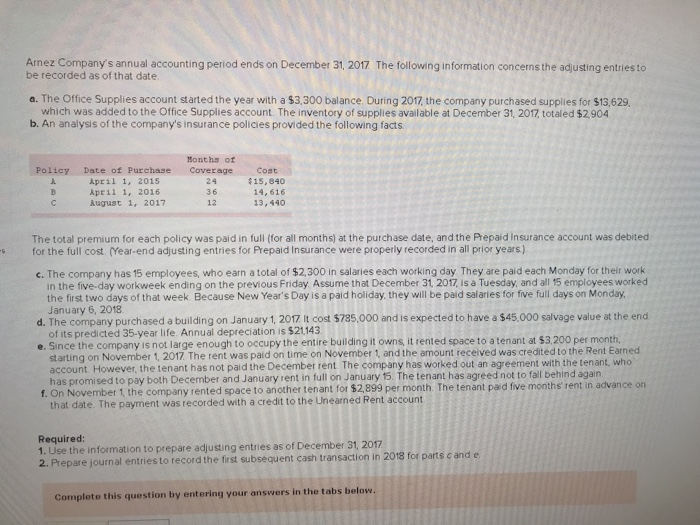

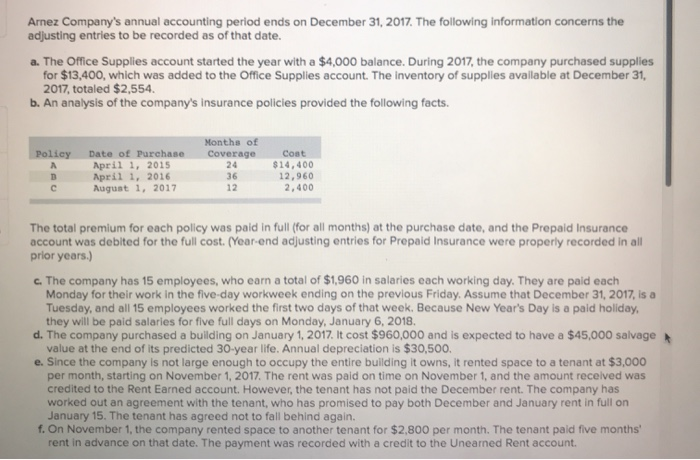

Trial balance for 31 October 2017. Electricity meter reading shows the 15000 units consumed during December 2016. The Office Supplies account started the year with a.

The inventory of supplies available at December 31 2017 totaled 2860. The company adjusts and closes its accounts at the end of the current accounting period. Enter debits before credits.

Services are performed and clients are billed for Rs. The company paid a 50 down payment and the balance will be paid after 60 days. 1 Answer to Problem 3-2A Preparing adjusting and subsequent journal entries LO C1 A1 P1 Arnez Companys annual accounting period ends on December 31 2017.

Ad Download over 20000 K-8 worksheets covering math reading social studies and more. There is an increase in an asset account debit Service Equipment 16000 a decrease in another asset credit Cash 8000 the amount paid and an increase in a liability account. 32500 of photography equipment in the business.

A Journal Entry is simply a summary of the debits and credits of the transaction entry to the Journal. On December 7 the company acquired service equipment for 16000.

Pin On Example Daily Weekly Schedule Template

Solved I M Having A Really Hard Time Doing This I Have Referenced Other 1 Answer Transtutors

1 Problem 3 2a Preparing Adjusting And Subsequent Chegg Com

Final Grading Exam Key Answers Bonds Finance Present Value

Solved The Smith Engineering Company Began Operations On Chegg Com

Arnez Company S Annual Accounting Period Ends On Chegg Com

Recenseo 2020 Comprehensive Examination Reviewer Material Pdf Debits And Credits Depreciation

1 Problem 3 2a Preparing Adjusting And Subsequent Chegg Com

Arnez Company S Annual Accounting Period Ends On Chegg Com

Arnez Company S Annual Accounting Period Ends On Chegg Com

1 Problem 3 2a Preparing Adjusting And Subsequent Chegg Com

Arnez Company S Annual Accounting Period Ends On Chegg Com

Harrison W Horngren C Thomas W Tietz W Financial Accounting 12ed 2019 Pdf Depreciation Inventory

Solved I M Having A Really Hard Time Doing This I Have Referenced Other 1 Answer Transtutors

Quizzer Cash Solution Printed Ko Cheque Debits And Credits