Accounting Worksheet Example Allowance For Doubtful Accounts

Provide allowance for depreciation on IT Equipment 8000. Closing inventory on 30 June 2018 60000.

Account For Uncollectible Accounts Using The Balance Sheet And Income Statement Approaches Principles Of Accounting Volume 1 Financial Accounting

Examples of an allowance for doubtful accounts ADA Here are a few examples of how to calculate your allowance for doubtful accounts.

Accounting worksheet example allowance for doubtful accounts. However because the worksheet refers to CA Carrying amount which is NET of allowance for doubtful debts the temporary differences relates to Allowance for doubtful debts- see below. Print Allowance of Doubtful Accounts Journal Entry Worksheet 1. Provide allowance for bad debts 10 of ending balance of debtors.

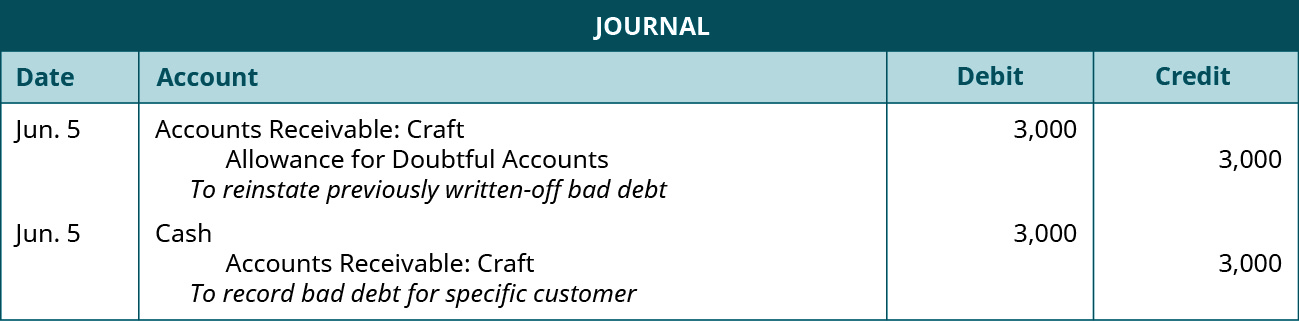

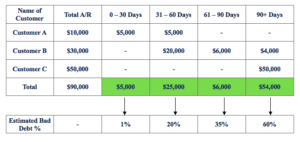

Allowance for Doubtful Debts DTA. For example based on previous experience a company may expect that 3 of net sales are not collectible. Aging of Accounts Receivable Excel model Aug 7 2015.

Allowance for Doubtful Accounts shows the estimated amount of claims on customers that are expected to become uncollectible in the future. Allowance for doubtful debts on 31 December 2009 was 1500. If the total net sales for the period is 100000 the company establishes an allowance for doubtful accounts for 3000 while simultaneously reporting 3000 in bad debt expense.

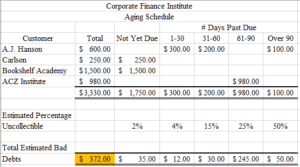

The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a companys balance sheet and is listed as a deduction immediately below the accounts receivable line item. The net realizable value of accounts receivable immediately after the write-off is. They have decided to make an allowance for doubtful accounts of 500 against the accounts receivable balance.

Discover learning games guided lessons and other interactive activities for children. Allowance for doubtful accounts on the balance sheet. A doubtful debt is an accounts receivable that is expected to be an uncollectible invoice where an accounts receivable is the amount owed to you against the sales you made or services you provided on credit.

Prepaid advertising 4800. Using the example above lets say that a company reports an accounts receivable debit balance of 1000000 on June 30. As a general allowance of 1500 has already been created only 500 additional.

Bad debts are only deductible for tax purposes when the debt is written off. Example of Allowance for Doubtful Accounts. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

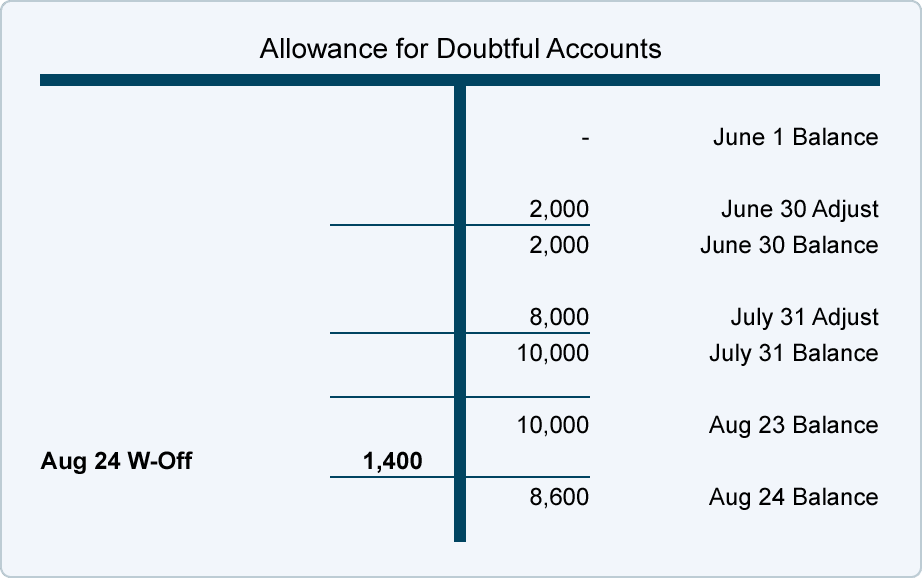

Allowance for Doubtful Accounts. Allowance for doubtful debt. On January 1 the Accounts Receivable balance was 18500 and the balance in the Allowance for Doubtful Accounts was 1400.

Discover learning games guided lessons and other interactive activities for children. In order to calculate the Allowance for Doubtful Accounts and the monthly Bad Debt Expense companies should regularly analyze the Aging of Accounts Receivable. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

A general allowance of 2000 50000-10000 x 5 must be made. Since the sales are made on credit there are chances that some customers might default their payments. Insurance expired 10000.

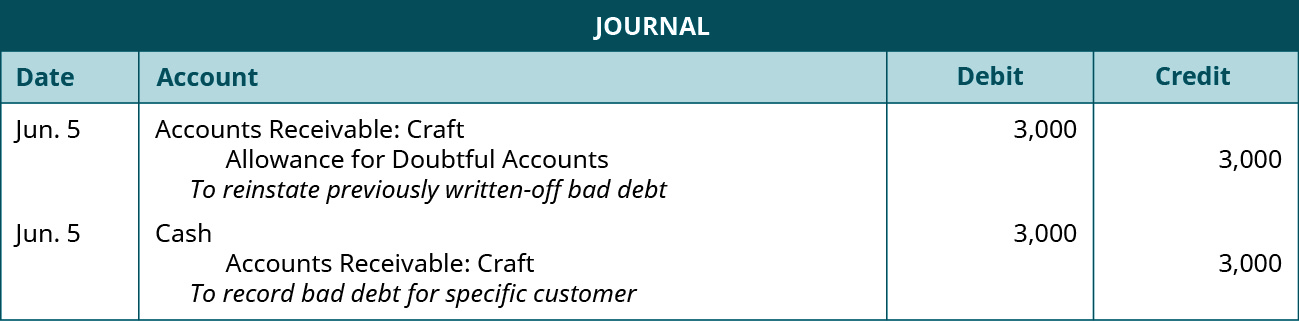

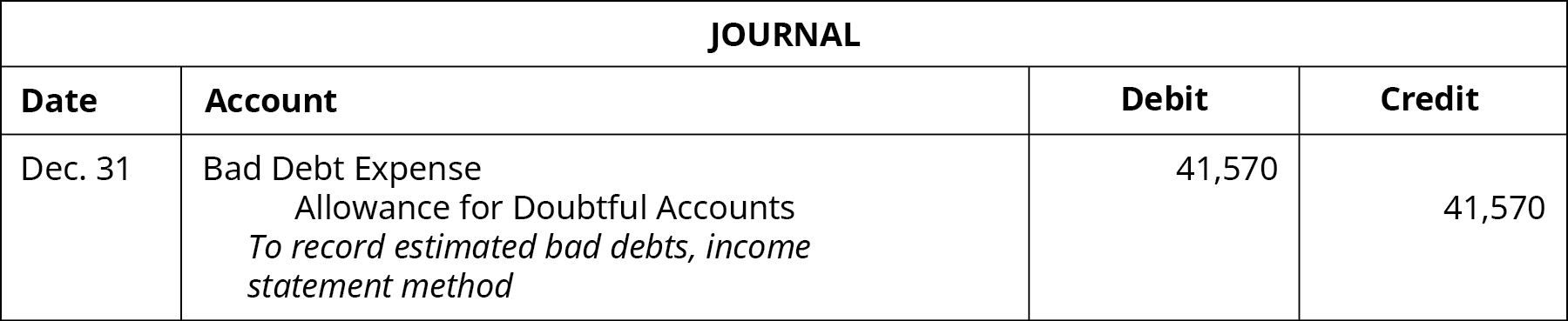

Accounting entry to record the bad debt will be as follows. A detailed article about this accounting topic can be read at this Accounting Coach post. Allowance for Doubtful Accounts is.

Identify the answer that is NOT a potential tool in analyzing the adequacy of the allowance for doubtful accounts. It may look something like this. Because an allowance for doubtful accounts is a contra asset that reduces your accounts receivables you record it under assets.

On January 15 a 400 uncollectible account was written-off. ABC LTD must write off the 10000 receivable from XYZ LTD as bad debt. This deduction is classified as a contra asset account.

The credit balance in the allowance account will absorb the specific write-offs when they occur. Outstanding payroll 8000. You are required to produce ten column worksheet.

When you create an allowance for doubtful accounts you must record the amount on your business balance sheet. As the Allowance for doubtful debt exists on the. The company anticipates that some customers will not be able to pay the full amount and estimates that 50000 will not be converted to cash.

A customer has been invoiced a total of 5000 for goods and the business has decided that there is doubt as to whether the customer can pay in full.

Estimating Bad Debts Allowance Method

Bad Debt Overview Example Bad Debt Expense Journal Entries

Accounting Unit 5 Part 3 Allowance For Doubtful Accounts Balance Sheet Method Youtube

Allowance Method For Uncollectibles Principlesofaccounting Com

Estimating Bad Debts Allowance Method

3 4 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting

Allowance For Doubtful Accounts Double Entry Bookkeeping

Allowance For Doubtful Accounts Definition Journal Entry Youtube

What Is The Allowance Method Online Accounting

Assessment Questions Pdf Free Download

Estimated Uncollectible Accounts Debit Or Credit Accounting Methods

Bad Debt Overview Example Bad Debt Expense Journal Entries

Allowance For Doubtful Accounts Overview Guide Examples

Chapter 8 Accounting For Receivables 1 2 1 3 4 5 6 7 4 5 6 7 8 12 13 14 15 16 Pdf Free Download

Allowance Method I Bad Debts I Examples I Accountancy Knowledge

Allowance Method For Bad Debt Double Entry Bookkeeping

Irrecoverable Debt And Allowance For Doubtful Debt Ppt Download

7 2 Accounting For Uncollectible Accounts Financial Accounting